Corporate Restructuring

More services to explore: Private Placement Programs (PPP) / Standby Letter of Credit (SBLC) issuance and monetization / Leased Bank Guarantee (BG)

-

8/F., Luk Kwok Centre,

72

Gloucester Road, Wanchai,

Hong Kong -

+852 3001 8851

- [email protected]

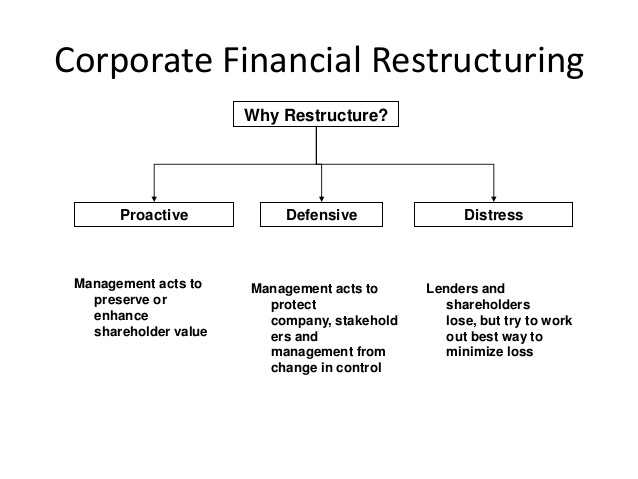

Corporate restructuring entails any fundamental change in a company’s business or financial structure, designed to increase the company’s value to shareholders or creditor. Corporate restructuring is often divided into two parts: financial restructuring and operational restructuring. Financial restructuring relates to improvements in the capital structure of the firm. An example of financial restructuring would be to add debt to lower the corporation’s overall cost of capital. If the firm is in bankruptcy, this financial restructuring is laid out in the plan of reorganization. The second meaning, operational restructuring, is the process of increasing the economic viability of the underlying business model. Examples include mergers, the sale of divisions or abandonment of product lines, or cost-cutting measures such as closing down unprofitable facilities